Please contact me

The Woodshed

Developments of the Indonesian Electronic Bond Market in 2022

It is nearly two years that IDX went live with their domestic Electronic Bond Market SPPA, this was back in November 2020. While this was a soft launch during the pandemic the platform continuously attracted more dealers in 2021 and the trading activity grew steadily during that period. There are now 30 dealers live on the platform of which there are 16 Primary dealers in SUN (standard Government Bonds) and 14 SUKUK Primary Dealers (Government Bonds issued under Sharia law). 2/3rd of the dealers are Banks and 1/3rd Security Houses or Brokers.

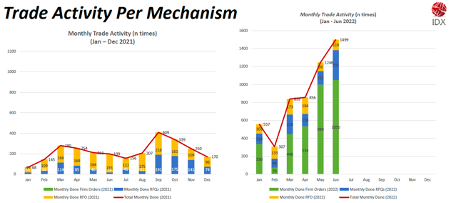

In 2021 most trades were executed via Request for Order (RFO), which is a bilateral trading protocol between two firms, followed by Request for Quote, a trading protocol where one dealer raises a request for a firm quote to multiple dealers on the platform.

The Indonesian SPPA trading venue hosted by IDX went officially live the beginning of November 2021 and from January 2022 mandatory quoting obligations for Primary Dealers have been introduced. The current quoting scheme covers 3 SUN and 4 SUKUK Benchmark Bonds. Those changes and the new suddenly available liquidity on the Centralised Order Book has led to an overall increase of more 400% in terms of number of trades year on year in the first halve of 2022 compared to the average trade count in 2021. Most trades are now executed via the Orders trading protocol raised on the Trading Board, RFQ’s also doubled in that period, while RFO’s trade numbers are stable with a small decrease of the average trading size for that particular trade type. Dealers now benefit from a more transparent market and a deep liquidity provided by the Primary Dealer community as there are now continuous available firm quotes on the back of the new quoting obligations scheme.

IDX and its software provider, AxeTrading, are continuously seeking to improve the ease of trading so dealers can trade with confidence on the electronic bond market with the AxeChange product which can be white labelled for other market providers. There will be further enhancements introduced to allow dealers to counter on counter for RFO and RFQ, as well as several security enhancements and other features relevant for fast developing emerging bond markets such as Indonesia. The software supports standard, retail and bonds issued under sharia law from Government and Corporate issuers both quoted in price and yield. It offers a comprehensive counter-party and credit limit management from a firm down to a user level, monitors quoting obligations which can be set up in a very flexible way, including periodic market snap shots. AxeChange can connect its dealers also via its FIX API, to allow QEMS solutions such as AxeTrader to be deployed to further enhance dealers bond trading. It also has a vast connectivity and reporting to Government and Settlement Agencies as well as Central Banks to allow real time trade reporting outside the platform. It also accommodates a bilateral trade cancel and amend protocol to ease the involvement of a platform provider. It’s unique and fully automated counter-party switching facility helps markets to overcome credit limit restrictions in the absence of a central counter-party.